March has arrived!

- Spring Training is in full bloom in Florida and Arizona. Who could ask for anything more? (Well, maybe more affordable homes for sale.)

Thanks to a recent suggestion from a reader, this issue of the Capital Commentary is shedding light on the hurdles impeding the growth of Black homeownership.

- To say the least, they’re formidable. But some of the nation’s most creative housing thinkers are taking aim at those barriers and we’ll review their recommendations.

Keep those suggestions coming for future newsletter and Arch MI PolicyCast topics via email at [email protected].

1. Big Thing: Daunting Barriers …

Why are many Black families on the outside looking in when it comes to homebuying? Consider just these two data points:

- More than 24% of Black families who applied for home purchase loans were denied in 2022, compared with 11% of white applicants.

- The combined wealth of the 400 richest Americans equals the cumulative wealth of the 48 million Blacks living in the U.S.

Why it matters: Increasing black homeownership can have a transformative impact on individuals, families and communities. It can help build wealth, improve stability and improve the health of Black Americans.

The roots of the problem can be traced back to government policies that benefited Whites at the expense of Blacks, such as the GI Bill and redlining, which we explored in a Capital Commentary last August.

- Racial inequity is compounded by the ongoing housing shortage and higher interest rates, which are pushing ownership costs higher and effectively locking out many low-wealth, first-time homebuyers.

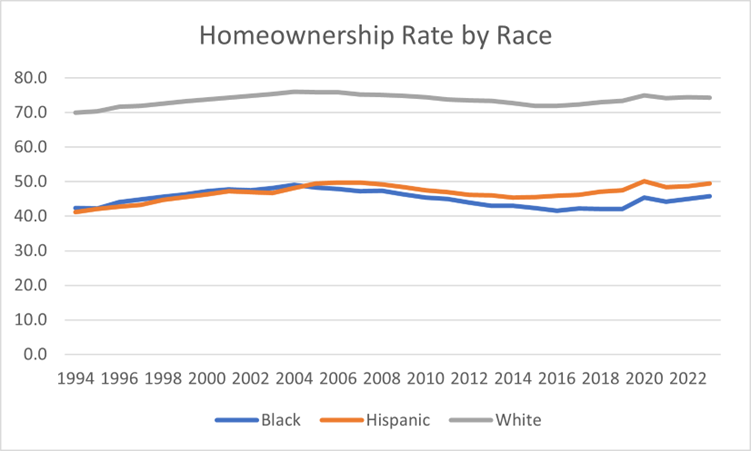

By the numbers: It’s no wonder, then, that the Black homeownership rate, at 45%, is 30 percentage points behind the White homeownership rate — wider than it was when segregation was legal.

The White-Black gap in homeownership rates has remained steady for three decades.

The bottom line: Homeowner equity is the most significant contributor to family wealth in the U.S. and is the primary reason the racial wealth divide is expanding.

- In 2022, median wealth held by Black families ($44,900) was just 15% of that held by White households.

- One in four Black households either had no wealth or were in debt.

What they’re saying:

“Gaining access to homeownership is one of the most direct and immediate ways to step out of the revolving door of generational economic stagnation.”

— 2023 State of Housing in Black America (SHIBA).

2. … That Might Get Worse

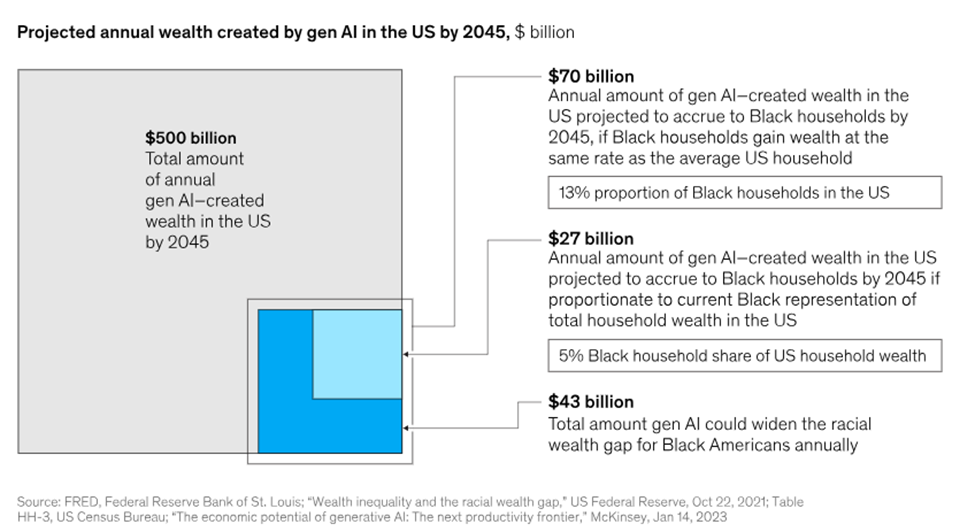

Generative AI, despite its potential for significant wealth creation, could inadvertently widen the racial wealth gap between White and Black households in the U.S. by $43 billion annually by 2045 if current trends persist.

- That’s the conclusion of a new report from McKinsey & Co. titled “The impact of generative AI on Black communities.”

By the numbers: McKinsey & Co. predicts that the United States could gain nearly $500 billion in household wealth from generative AI value creation by 2045.

“This increase would translate to an average of $3,400 in new wealth for each of the projected 143.4 million US households in 2045.”

Yes, but: That’s a lot of wealth creation, but it threatens to make White households much richer than Black ones, say the authors.

McKinsey calculates that unless longstanding patterns are corrected, Black Americans will end up on the short end of the stick as Generative AI transforms the economy.

What they’re saying:

“Black Americans capture only about 38 cents of every dollar of new household wealth despite representing 13 percent of the US population. If this trend continues and projections of the growth of Black households are accurate, by 2045, racially disparate distribution of new wealth created by gen AI could increase the wealth gap between Black and White households by $43 billion annually.”

The big picture: Black Americans, notes McKinsey, are overrepresented in fields most at risk of automation: office support, production work, food services and mechanical installation and repair.

On the other hand: Generative AI does offer some upsides to building wealth for Black Americans:

- It could connect Blacks with new, tailored financial products.

- It could reimagine creditworthiness and risk to make homeownership accessible to Blacks who do not have credit scores.

3. Boosting Black Wealth: Oscar-Nominated Documentary

This Oscar-nominated New Yorker Documentary movie tells how one person, Arlo Washington, has made a difference in boosting Black wealth and incomes. Click the movie poster above to watch the short film.

4. Boosting Black Wealth: Oscar-Nominated Documentary

Experts suggest a combination of education, targeted programs and innovations can lead to more Black homeowners.

Back to basics: Financial literacy is “the civil rights issue of this generation,” says Eric Kaplan, President of Operation HOPE’s Financial Literacy for All (FL4A) initiative.

- FL4A is a 10-year commitment to educate both youth and adults so they can make confident financial decisions about their futures.

- Its leadership includes the CEOs of Walmart, Delta, Bank of America and the NFL, as well as a host of other business executives.

Andrew Davidson, CEO of his eponymous firm and a leader in mortgage research, joined Kaplan on a panel at the recent Structured Finance Association’s annual conference to discuss his own financial literacy creation, Financial Life Cycle Education Corporation (FiCycle).

- FiCycle is a math-based curriculum that links traditional high school math topics with financial decision making.

- FiCycle isn’t a cursory look at finance, either. It covers such topics as exponents, series, sequences, probability and expected value.

FICycle recently won praise from New York Times economics columnist Peter Coy as a way to encourage students to master math.

Why it matters: Kaplan and Davidson worry that the wealth gap will grow exponentially unless students are better educated about the impact of their financial choices.

What they’re saying:

“Working in finance, we see that many people struggle to understand the role of money in their lives and that many lack the analytical framework to make effective financial decisions. To help address these problems, we created a high school math course that helps students understand the role of financial instruments in transferring wealth across time and managing financial uncertainty.”

— Andrew Davidson

Public policymakers can advance Black homeownership, too.

- Targeted initiatives such as Special Purpose Credit Programs and first-generation down payment assistance programs could make homeownership possible for millions of Black families, according to the Urban Institute.

- Enacting legislation such as the Neighborhood Homes Investment Act to preserve existing single-family units would help address the nation’s housing shortage.

Additionally, innovations including new credit scoring models might qualify more Black borrowers for home loans, while shared-equity programs, usually offered by nonprofits but increasingly available from private sources, can lower barriers to homeownership.

- Between 2011 and 2022, the number of nonprofits with shared-equity programs and community land trusts increased by 30%.

- 58% of shared equity programs prioritize racial equity for Black, Indigenous and people of color (BIPOC) communities over economic equity and race blindness.

The bottom line: There is no single solution to solving the hurdles facing Black Americans trying to become homeowners. But progress can be made if policymakers and private entrepreneurs align on a mission to increase knowledge, opportunity and housing supply.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.