Before You Lock with FHA: Take 30 Seconds to Check Your Member’s Savings with Arch MI

Saving your customers money is time well spent. And you can check Arch MI’s rates against FHA faster than you can tie your shoes.

Save a typical pair of homebuyers with good credit more than $145 per month over FHA by getting a quick, no-hassle RateStarSM quote via your LOS/PPE, the archmicuratestar.com portal or our mobile app.

Deliver Long-Term Savings

A conventional loan insured with Arch MI continues to deliver significant savings year after year. Our MI coverage is cancelable, but most FHA homebuyers — those making down payments of less than 10% — continue paying FHA’s MI premium for the entire life of the loan.

*Assumptions: Arch MI Borrower-Paid Monthly: Base loan amount $350,000, two members, both with 720 credit scores, 41% DTI, 30-year fixed-rate purchase loan, single-family house, stable market, 95% LTV Arch MI and 96.5% LTV FHA. Life of loan is a 30-year amortized period, assuming on-time payments for 360 months. MI premium rates will vary depending on member credit score and characteristics. RateStarSM pricing as of Jan. 31, 2022. FHA Rate source: FHA Mortgagee Letter 2017-7.

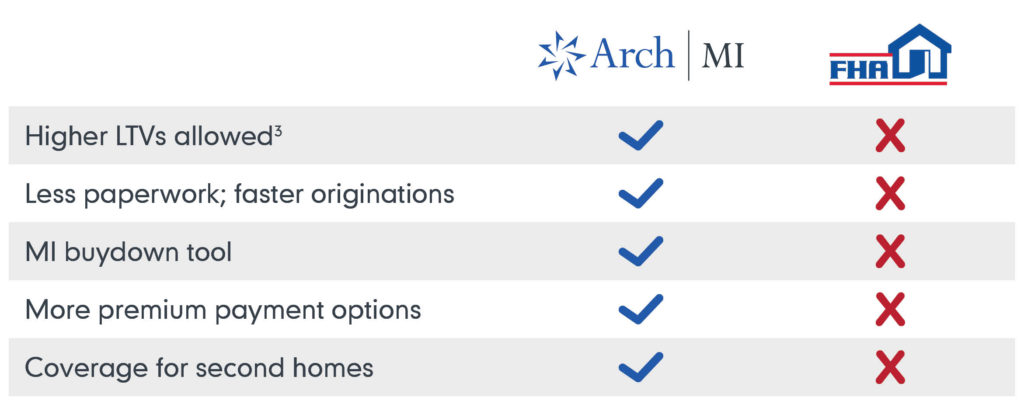

See How Arch MI Stacks up Against FHA

- Lower monthly payments for most members.

- Faster closings with less paperwork.

- Coverage for second homes.

- More premium payment options, including single, monthly and lender-paid.

- Arch MI allows higher LTVs than FHA.2

2 For additional details, please refer to Arch MI’s Credit Union Underwriting Manual.

With Arch MI, members also close faster with less paperwork and skip FHA’s 1.75% upfront payment.

Arch MI Offers More Options