Quality Control

Arch MI’s Quality Control (QC) team evaluates, monitors and assesses the risk to the company of loans that Arch MI is insuring while adhering to the Private Mortgage Insurer Eligibility Requirements (PMIERs) set forth by the Agencies.

The QC department is responsible for the following practices:

- Auditing insured loans received from all delivery channels, including delegated and non-delegated loans.

- Reporting findings to external customers, internal stakeholders and Arch MI senior management.

- Identifying risk issues and mitigating negative impacts to Arch MI.

- Monitoring and tracking action plans associated with material risk issues and trends.

- Rescinding coverage on loans with confirmed fraud or significant deficiencies.

- Handling self-reported issues: Credit unions must notify Arch MI if they become aware that an insured loan is subject to a Significant Defect, Single-Loan Fraud, Pattern Activity or is required by the GSE or investor to be repurchased based on a Significant Defect, Single-Loan Fraud or Pattern Activity. This Self-Reporting notification must be made within thirty (30) days of discovery by the Insured or within thirty (30) days of a required repurchase.

If you have questions, please contact the QC team at 888-844-6787 or [email protected].

Related Links

- Day One Protection Flyer (PDF)

- Delegated Checklist and Submission Options (PDF)

- Non-Delegated Checklist and Submission Options (PDF)

- File Request Template (XLSX)

- Preliminary Results Template – Moderate Findings (XLSX)

- Preliminary Results Template – Significant Findings (XLSX)

- Final Results Template (XLSX)

- Self-Reporting Loans with Defects (PDF)

- QC Underwriting Tips

- QC Process Tips

- CONNECT QC Dashboard Quick Reference Guide

- Loans with Significant Defects

How It Works

How to Submit Files

QC offers various options for credit unions to submit files, including:

- CONNECT

- Secure File Transfer Protocol (FTP)

For additional submission options or to request accounts, please see the Delegated (PDF) or Non-Delegated (PDF) Quality Control Checklists and Submission Options.

The Loan Review Process

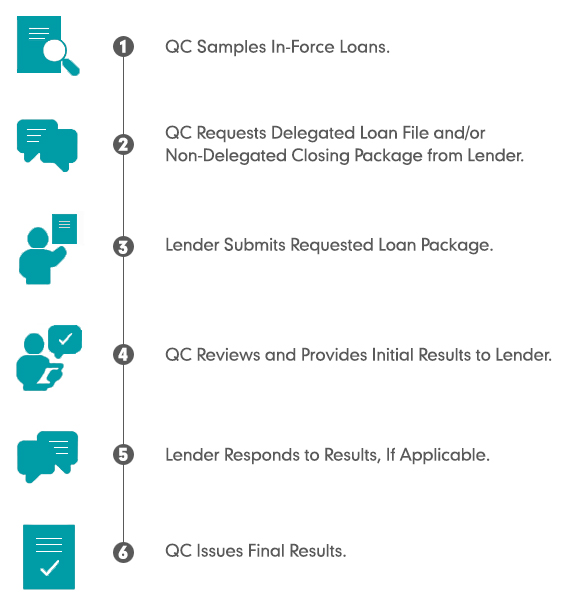

As dictated by the PMIERs, QC randomly samples from our book of business for both delegated and non-delegated files and then requests the documentation from the lender necessary to review the loan. QC reviews the information provided and then sends the initial results to the lender. The lender has an opportunity to respond before QC issues final results.

How to Interpret Results

Reviewed loans will fall into one of two categories:

- Insurable — These loans are granted early rescission relief (PDF) because they meet Arch MI’s underwriting guidelines and represent an acceptable level of insurance risk. Loans are insurable even when they have less severe errors that do not impact the loan’s insurability.

- Uninsurable — These are loans that do not meet Arch MI’s underwriting guidelines and do not represent an acceptable level of insurance risk. The insurance coverage on uninsurable loans is rescinded by Arch MI and all premiums already paid to Arch MI are refunded to the lender.