QC Process Tips

Questions about Arch MI QC’s Loan File Requests

In addition to monitoring the risk of the loans we insure, Arch MI QC is also required by the GSEs to meet their Private Mortgage Insurer Eligibility Requirements (PMIERs). To comply, we are required to randomly sample from our entire book of business for both delegated and non-delegated files.

For non-delegated loans, QC is required to review the Arch MI underwriter’s decision and the closing package to ensure that the loan closed as it was submitted. For non-delegated loans, QC only requires a review of the closing package and any origination documents that may have been updated after Arch MI Underwriting approved the loan.

Arch MI’s QC department is required by the GSEs to meet PMIERs rules; however, we also strive to work with customers as much as possible through this process.

Random Audit:

- Random audits are the most objective type of review.

- Random audits are sampled from the entire book of business.

- Samples are selected on a monthly basis, but they are requested from the individual lender no more than quarterly.

Discretionary Audit:

- Discretionary audits focus on higher-risk loans.

- Common discretionary audits include newly delegated credit unions, credit unions with previous QC concerns and Early Payment Default (EPD) loans. Note: QC audits 100% of EPD loans per PMIERs.

- Discretionary audits are selected monthly.

- Audits can be initiated when potential issues are self-reported by a credit union. For example, when a credit union discovers a guideline infraction, misrepresentation, documentation issue, etc., on a closed file in their pipeline, QC will request the loan for review. Note: Lenders are responsible for disclosing to Arch MI when issues are discovered through their own QC reviews, Agency reviews, etc.

Delegated

Please use the online version of the QC Delegated Checklist and/or the Detailed Submission Option Instructions.

Non-Delegated

Please use the online version of the QC Non-Delegated Checklist and/or the Detailed Submission Option Instructions.

Arch MI QC allows the customer 15 business days from the requested date to provide the file. A file is considered past due if it is not received by the 15th business day.

Prior to the due date, Arch MI QC will follow up via phone and email once to determine if the file request was received. If the file is not received by the 15th business day, QC will follow up with the customer up to four more times.

Once the file request is 60 days past due, a final email will be sent to the customer explaining the interruption of claim payment or possible rescission if the requested loan file is not provided.

Arch MI QC requests that updated contact information be sent to [email protected]. Please provide the new contact’s name, email and phone number.

Arch MI QC has two submission options:

Option 1: CONNECT (Arch MI Preferred Option)

To obtain CONNECT credentials: https://connect.archmi.com/originations/request-account.

To submit documents: https://connect.archmi.com/originations/.

Option 2: File Transfer Protocol (FTP).

To obtain FTP credentials: https://request.archmi.com/.

To submit documents: https://filetransfer.archmi.com/EFTClient/Account/Login.htm.

Contact Arch MI Customer Service Support at 877-642-4642 or [email protected].

In order to ensure QC files were uploaded, follow these steps:

- Log into https://connect.archmi.com/originations/.

- Enter the Arch MI Cert# into the Search field (located at the top of page under our logo) and click Search.

- Once the cert comes up, look to the right and you will see three dots stacked on top of each other.

- Hover your mouse over those dots and choose Quality Control.

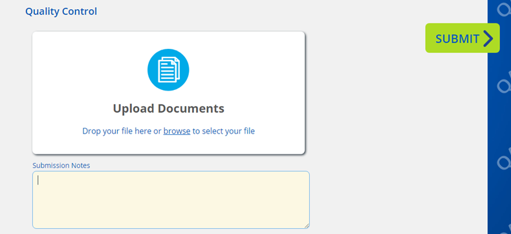

- The Upload Documents page will allow you to drag and drop documents there or browse.

- Once documents are loaded, click Submit. Please see the screenshot below.

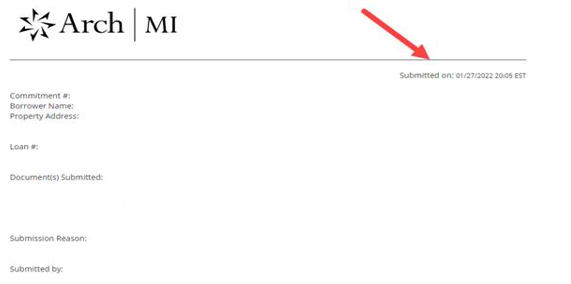

- The next page will provide a time stamp of submission along with document information. Please see screenshot below.

An Arch MI QC Specialist will provide the customer the updated username and password via email once the FTP credentials have been reset.

Internal

Arch MI QC has requested that internal employees send Self-Report issues to [email protected] and use the following format when informing QC of self-reported issues:

- Subject line should contain the certificate #, credit union name and SELF-REPORTED.

- The email should include details on the issues (if provided by the customer).

- The email should include any supporting documentation provided by the reporter.

External

Arch MI QC has requested that external customers send Self-Report issues to [email protected] and use the following format when informing QC of self-reported issues:

- External customers may submit self-reported loans in any format (verbal or written communication).

- The communication may reference the loan as being self-reported or may not.

Arch MI QC provides the loan number shown in our internal system on loan file requests. The internal system often gets updated if the loan servicer uses a number different from what the originating credit union used.

Arch MI QC encourages files to be sent to [email protected] by the prescribed due date in order to provide you with timely results and to meet the GSE requirements. We understand, however, if additional time is needed. In some situations, QC may grant an extension up to five business days.

Arch MI QC is not able to waive files selected for review. The loan file was selected for sampling based on PMIERs sampling requirements.

Arch MI QC only requires legal resident documents on loans where there is a question of legal residency. For example, if the member is a U.S. citizen, then no documentation is required. If the member is not a U.S. citizen, Arch MI would require the same documentation as required by the Agencies, such as a Permanent Resident Card (“Green Card”) or temporary work visa.

Questions About Responding to Arch MI QC’s Findings

Arch MI QC strives to complete all randomly selected post-close loan reviews within 120 days of the latest insured date. Additional time may be required for discretionary and delinquent loan reviews.

Arch MI QC reviews loans in the order that they are received. When a review has been completed, you can expect to receive the results via email from [email protected].

Arch MI QC will email your preliminary results and you will have five business days to respond to any findings identified as moderate or significant.

If your loans do not contain any findings or only contain minor findings, Arch MI QC will email your final results and no response will be necessary.

Please review the findings and respond to Arch MI QC within five business days of receipt of the preliminary results. Response documents and explanations can be submitted through the normal file submission process. If you are unsure what is needed to clear up a finding(s), please contact us via phone at 888-844-6787 or email at [email protected].

The preliminary results email will provide the date the response is due.

Your response can be entered into the preliminary results report and then returned to Arch MI QC along with any supporting documents.

If you choose to only supply additional documentation without entering a response on the preliminary report, please be sure to include the Arch MI Certificate number with the additional documentation.

The Arch MI QC review is based on the data input into the MI system at the time of submission. No change is required, but it can be updated by contacting Arch MI customer service via phone at 877-642-4642 or email at [email protected].

Yes, we prefer all the loan responses to be provided together by the response due date.

Yes, you may email us a request to [email protected]. Please note that due to Nonpublic Information (NPI) restrictions, we may be limited on the documentation we can provide.

No, because once the file is imaged into the MI system, it is not in the same order as originally submitted. The missing documentation would need to be resubmitted.

If Arch MI QC does not receive your response by the required due date, it can result in rescission of MI coverage and/or impact your quality ratings.

Arch MI QC typically reviews responses and issues final results within 10 business days of receipt of your response. We may delay issuing final results beyond 10 days if your loan is uninsurable with the potential for rescission. In this case, we will work with you to resolve the issue, if possible.

Final results will include both the finding at the time of the preliminary result and at the time of final. If the finding remains, it will show in both the Preliminary Results column and the Final Results column. If you see “Insurable Risk – Loan passes QC review” under the final Results column, this means the finding was cleared.

Yes, Arch MI QC will accept and review any new documentation for consideration. If a finding can be cleared, a new final results report will be provided via email.

The Insured must notify Arch MI if they become aware that an insured loan is subject to a Significant Defect, Single-Loan Fraud, Pattern Activity or is required by the GSE or the investor to be repurchased based on a Significant Defect, Single-Loan Fraud or Pattern Activity. This notification is called Self-Reporting and must be made within 30 days of discovery by the Insured or within 30 days of a required repurchase. After being notified, Arch MI will conduct its own independent QC review of the loan and determine whether the coverage can be retained or needs to be rescinded. If the Insured fails to disclose the Significant Defect to Arch MI in a timely manner, Arch MI has the right to cancel coverage or deny an existing or future claim request.

A rescission occurs when Arch MI terminates coverage of a loan and returns all premiums received on the affected loan. Coverage is deemed to never have been in force on that loan. Cancellation is when either Arch MI or the Insured terminates coverage. No accrued premiums are returned to the insured with a cancellation.